Technical Indicators for MetaTrader 5

Shopping cart

MetaTrader 5

Top Rated Products MT5

Overview

Introduction

Channel indicators are widely used in technical analysis, offering valuable insights into price movements, trend identification, and volatility. Most channel-based indicators, such as Bollinger Bands and Keltner Channels, rely on a central tendency estimator (e.g., a moving average) combined with a volatility component to define upper and lower bands.

The G Channels indicator takes this concept further by leveraging a highly efficient recursive calculation. This unique approach ensures that the indicator dynamically adapts to market conditions while maintaining computational efficiency. Additionally, the midline of the channel provides a robust central tendency estimator, similar to the average of the highest and lowest prices over a given period.

How It Works – Efficient Calculation

The core efficiency of G Channels comes from its recursive structure, allowing the indicator to use past output values as input. The calculation of the upper band is as follows:

a = max ( s r c , n z ( a ( 1 ) ) ) − n z ( a ( 1 ) − b ( 1 ) ) l e n g t h a = \max(src, nz(a(1))) - \frac{nz(a(1) - b(1))}{length} a=max(src,nz(a(1)))−lengthnz(a(1)−b(1))Where:

- src: Closing price

- a: Upper band

- b: Lower band

This ensures that the upper band never decreases unless corrected by a calculated adjustment factor derived from the difference between a and b. A similar process is applied to the lower band, ensuring both boundaries adapt smoothly to price movements.

For an even more efficient approach, the calculation could be reduced to:

a = max ( s r c , n z ( a ( 1 ) ) ) − n z ( a b s ( c l o s e − a ( 1 ) ) ) l e n g t h a = \max(src, nz(a(1))) - \frac{nz(abs(close - a(1)))}{length} a=max(src,nz(a(1)))−lengthnz(abs(close−a(1)))This method, detailed in the research paper "Recursive Bands – A New Indicator for Technical Analysis", has been successfully applied in other tools like the Adaptive Trailing Stop indicator.

The Central Tendency Estimator & EMA 200 Signal

One of the key innovations in G Channels is its central tendency estimator, which is calculated as the average of the upper and lower extremities. This behaves similarly to the midline in Donchian Channels, offering a clear view of the overall market direction.

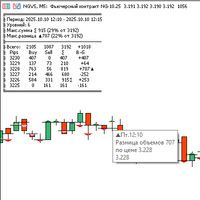

Buy & Sell Signal – EMA 200 Cross Strategy

A powerful trading signal is generated when the average band crosses the 200-period Exponential Moving Average (EMA 200):

- Buy Signal: When the average band crosses above the EMA 200, indicating a potential uptrend.

- Sell Signal: When the average band crosses below the EMA 200, signaling a possible downtrend.

This crossover strategy helps traders confirm market direction and improve trade accuracy.

Key Features

- Highly Efficient Calculation – Uses recursion for optimized performance.

- Adaptive Channel Levels – Adjusts dynamically based on price movements.

- Central Tendency Estimator – Provides a reliable midline for trend analysis.

- EMA 200 Crossover Signals – Strong buy/sell confirmations.

- Breakout & Reversal Detection – Helps identify key trading opportunities.

- Support & Resistance Levels – Acts as dynamic zones for price reactions.

How to Use G Channels in Trading

- Trend Following: Buy when price bounces off the lower band in an uptrend, sell when it rejects the upper band in a downtrend.

- Breakout Trading: Enter trades when price closes beyond the channel boundaries.

- EMA 200 Crossover Strategy:

- Buy when the average band crosses above EMA 200.

- Sell when the average band crosses below EMA 200.

- Support & Resistance: Use the bands as dynamic zones to anticipate price reactions.

Conclusion

G Channels introduces an innovative and efficient way to analyze price movements. Its recursive calculation method ensures accuracy while maintaining a lightweight footprint, making it ideal for traders who seek reliable trend confirmation, breakout signals, and adaptive support/resistance levels.

With the EMA 200 crossover strategy, traders can confidently identify buy and sell opportunities based on a widely used trend filter.

Get G Channels today and enhance your market insights!